Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

What our research reveals about its strength, strategy, and suitability for long-term investors

In our effort to make financial analysis easier for investors, we recently checked Everest Bank’s performance over the last five years. We aimed to look past simple financial ratios to see how the bank works, what its trends are, and what they mean for long-term investors.

Our findings showed that the bank has been consistently strong and disciplined. Everest Bank does not focus on fast growth; rather, it is slowly making the bank stronger and more efficient, making it ready for both stability and sustainability.

A focus on Profitability, But with Discipline

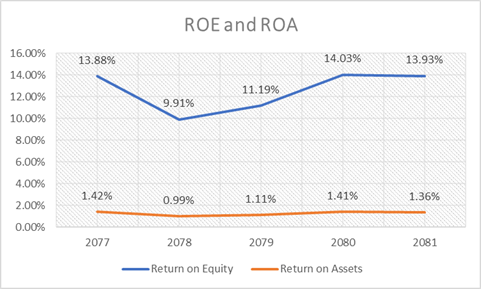

Everest Bank remains profitable year after year, although it’s clear that the golden years of exceptionally high returns are gone. In FY 2077, the bank recorded a Return on Equity (ROE) of 13.88%, which has remained relatively stable, standing at 13.93% in FY 2081. Similarly, Return on Assets (ROA) is holding at 1.36%, reflecting solid, consistent performance. More importantly, net profit margin has remained almost 20% for several years now. This proves the bank is handling income and expenses well, even though interest margin are not as high as before.

That brings us to a key metric that drives profitability in any bank, the Net Interest Margin (NIM). This figure reflects the difference between what the bank earns from lending and what it pays for deposits. For most banks, a NIM between 3% and 4% is considered healthy. Everest Bank has consistently delivered a NIM of 3.40% in recent years, which is right in that ideal range. While this is not high by aggressive growth standards, it shows that the bank is earning steadily from its core operations without taking unnecessary risks.

Strengthening Liquidity- Playing it Safe

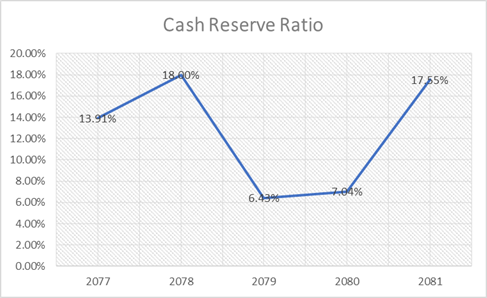

One of the strongest areas in Everest Bank’s financial profile is its liquidity position. The Cash Reserve Ratio (CRR) was significantly increased 17.55% in FY 2081, compared to just 7.04% two years earlier. This indicates the bank is holding more cash and near-cash assets, so it can deal with stress or withdrawals without problems. Additionally, its Liquid Coverage Ratio (LCR) which is a critical stress test measure stands at 147% well above regulatory minimums. This reinforces our view that the bank is taking a conservative and safe approach in managing short-term obligations.

With financial risks growing around the world, the bank’s high liquidity is a good sign of good management decisions.

Improved Efficiency and Cost Discipline

Efficiency has clearly improved across operations. Everest Bank has lowered its Cost to Income Ratio to 37.45%, a significant improvement from 46.62% just four years ago. Meanwhile, the bank’s Operating Profit Margin has steadily increased to 59.58%, showing that the bank is not only cutting costs but also getting more out of its core banking activities. This level of discipline in spending and income management signals that the bank is being run with long-term sustainability in mind, rather than chasing short-term optics.

Some Caution Around Credit Quality

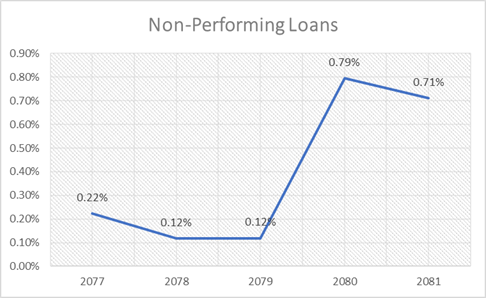

While overall asset quality remains strong, there are a few early signs of risk. Non-Performing Loans (NPLs) have gradually increased from 0.12% in FY 2079 to 0.71% in FY 2081. Though this is still very low by industry standards, the upward trend should not be ignored. Fortunately, the bank continues to maintain a strong Provision Coverage Ratio of 174.20%, ensuring that even if defaults increase, the bank has sufficient buffers to absorb losses without damaging its capital.

Solid Capital and Risk Management

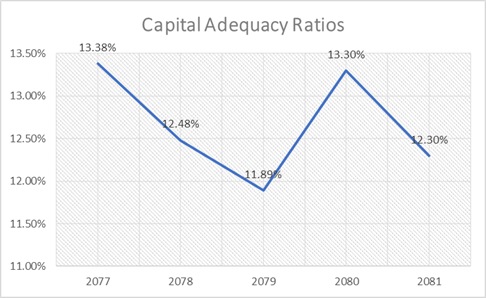

Everest Bank continues to meet and exceed capital adequacy requirements. Its Capital Adequacy Ratio (CAR) is at 12.30%, with a strong Tier 1 Capital Ratio of 10.59%. These figures confirm the bank has more than enough capital to absorb shocks or credit losses, which is critical for long-term stability. Its Leverage Ratio which is a measure of how much debt it uses remains modest at 6.12%, suggesting a healthy balance between risk and return.

Conclusion: A safe, Long-term Bet for Conservative Investors

Our research on Everest Bank paints the picture of a mature, well-managed, and conservative institution. This is not a bank chasing rapid growth, nor is it taking undue risks to boost short-term profits. Instead, it’s prioritizing liquidity, operational efficiency, and sound risk management which are the qualities that are often overlooked in favor of flashy returns.

Yes, profitability has declined from its peak years, and yes, there are mild concerns around rising NPLs. But the bank’s strong capital base, growing efficiency, and robust liquidity position more than compensate for those risks. For long-term, conservative investors especially those looking for steady returns and capital preservation- Everest Bank offers a compelling case. It might not deliver the highest return in the market, but it does deliver reliability, resilience, and responsible banking, which are increasingly rare and valuable in today’s financial world.

Disclaimer: This research report is prepared for informational and educational purposes only. It does not constitute investment advice, a recommendation, or an offer to buy or sell any financial instrument or security. While we have made every effort to ensure the accuracy of the data and analysis presented, we do not guarantee its completeness or reliability. The views expressed are based on publicly available information and our interpretation of financial data as of the time of writing. Readers are encouraged to conduct their own due diligence or consult with a licensed financial advisor before making any investment decisions. Past performance is not indicative of future results. We do not accept any liability for any loss or damage arising directly or indirectly from the use of or reliance on the information contained in this report.